What is Spark?

- Strengthening People and Revitalizing Kansas

- allocated to local governments to help address the health and economic challenges associated with COVID-19 from the federal Coronavirus Aid, Relief and Economic Security (CARES) Act.

- Federal funds approved through the Coronavirus Aid, Relief and Economic Security (CARES) Act were allocated to each state.

- Kansas was awarded $400 million from the Coronavirus Relief Fund (CRF)

- The Strengthening People and Revitalizing Kansas Task Force was established to prioritize the distribution of CRF funds to each Kansas county.

What is the mission of SPARK?

- To serve our immediate health and economic needs & leverage these investments to create a better, stronger future

What is the purpose of the Coronavirus Relief Fund (CRF) through the CARES Act?

- The Coronavirus Relief Fund (CRF) provided, in Section 5001, $150 billion to be used to make specific payments to states and local governments to offset certain costs associated with the COVID-19 Pandemic.

What are the restrictions of the CRF?

CRF can only be used for certain expenditures:

- Necessary public health (COVID-19) emergency expenses

- Not accounted for in the budget approved as March 27, 2020

- Incurred from March 1 to December 30,2020

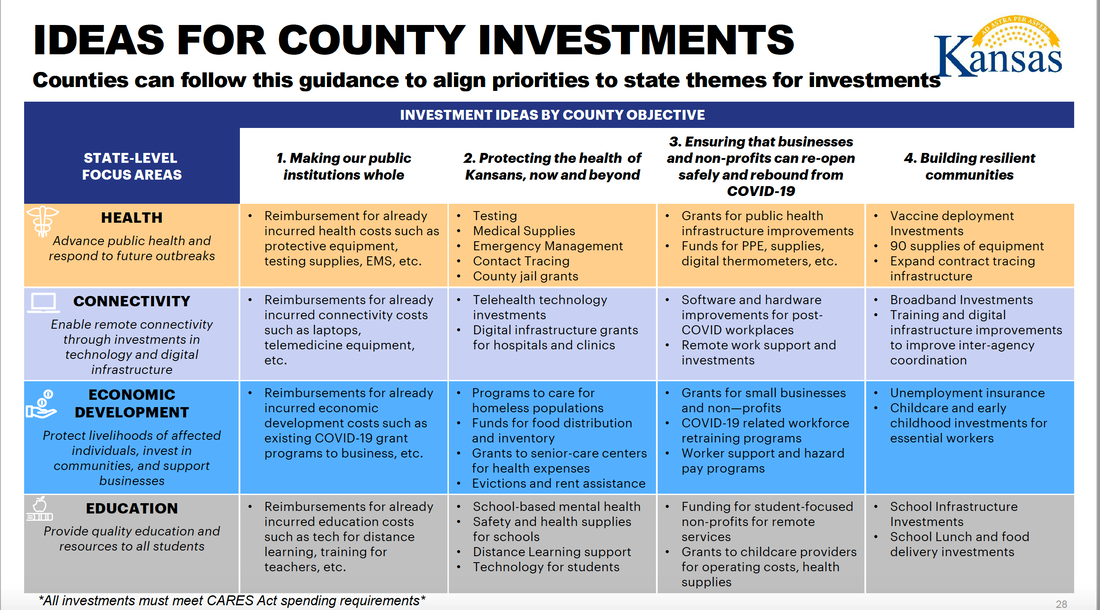

What are the themes the state has for COVID-19 related spending?

Health

- Advance public health and respond to future outbreaks

- Enable remote connectivity through investments in technology and digital infrastructure

- Protect livelihoods of affected individuals, invest in communities, and support businesses

- Provide quality education and resources to our students

What objectives can the county use as a framework to plan and prioritize their investments for COVID-19 related spending?

1. Making our public institutions whole

• Reimbursements for COVID-19 Related Expenses from Public Entities

2. Protecting the health of Kansas

• Ensure access to supplies and infrastructure to mitigate disease spread and preparing for a potential “second wave” in the fall

3. Revitalize local businesses

• Ensuring that businesses and non-profits can re-open safely and rebound from COVID19

4. Building resilient communities

• Supporting workforce, housing, childcare, social services, and other investments critical for long-term and community growth

• Reimbursements for COVID-19 Related Expenses from Public Entities

2. Protecting the health of Kansas

• Ensure access to supplies and infrastructure to mitigate disease spread and preparing for a potential “second wave” in the fall

3. Revitalize local businesses

• Ensuring that businesses and non-profits can re-open safely and rebound from COVID19

4. Building resilient communities

• Supporting workforce, housing, childcare, social services, and other investments critical for long-term and community growth

What are eligible expenditures?

Medical expenses (examples below)

Payroll Expenses (examples below- not replace or supplant PPP)

Economic Support (examples below)

- COVID-19-related expenses of public hospitals, clinics, and similar facilities.

- Establishing temporary public medical facilities and other measures to increase COVID-19 treatment capacity, including related construction costs. • Providing COVID-19 testing, including serological testing.

- Emergency medical response, including emergency medical transportation, related to COVID-19.

- Expenses for establishing and operating public telemedicine capabilities for COVID-19related treatment."

- Expenses for communication and enforcement of public health orders related to COVID-19.

- Acquisition and distribution of medical and protective supplies, including sanitizing products and PPE, for medical personnel, police officers, social workers, child protection services, and child welfare officers, direct service providers for older adults and individuals with disabilities in community settings, and other public health or safety workers connected to COVID-19 public health emergency.

- Disinfection of public areas and other facilities, e.g., nursing homes.

- Technical assistance to local authorities or other entities on mitigation of COVID-19-related threats to public health and safety.

- Public safety measures undertaken in response to COVID-19.

- Expenses for quarantining individuals.

Payroll Expenses (examples below- not replace or supplant PPP)

- The Fund is designed to provide ready funding to address unforeseen financial needs and risks created by the COVID-19 public health emergency, therefore a local government may presume that payroll costs for public health and public safety employees are payments for services substantially dedicated to mitigating or responding to the COVID-19 public health emergency, unless the chief executive (or equivalent) of the relevant government determines that specific circumstances indicate otherwise.

- Increased workers compensation cost to the government due to the COVID-19 public health emergency incurred during the period beginning March 1, 2020, and ending December 30, 2020, is an eligible expense.

- Use of payments from the Fund to cover payroll or benefits expenses of public employees are limited to those employees whose work duties are substantially dedicated to mitigating or responding to the COVID-19 public health emergency. Examples of types of covered employees, or classes of employees, include: Public Safety, Public Health, Health Care, Human Services

- Similar employees whose services are substantially dedicated to mitigating or responding to the COVID-19 public health emergency

- Payroll and benefit costs associated with public employees who could have been furloughed or otherwise laid off but who were instead repurposed to perform previously unbudgeted functions substantially dedicated to mitigating or responding to the COVID-19 public health emergency are also covered.

- Payroll and benefit costs of educational support staff or faculty responsible for develoPing online learning capabilities necessary to continue educational instruction in response to COVID-19-related school closures.

- Food delivery to residents, including, for example, senior citizens and other vulnerable populations, to enable compliance with COVID-19 public health precautions.

- Facilitation of distance learning, including technological improvements, in connection with school closings to enable compliance with COVID-19 precautions.

- Improve telework capabilities for public employees to enable compliance with COVID-19 public health precautions.

- Providing paid sick and paid family and medical leave to public employees to enable compliance with COVID-19 public health precautions.

- Maintaining state prisons and county jails, including sanitation and improvement of social distancing measures, to enable compliance with COVID-19 public health precautions.

- Care for homeless populations provided to mitigate COVID-19 effects and enable compliance with COVID-19 public health precautions.

- Ongoing expenses from decommissioned equipment placed back into use or an unplanned lease renewal in order to respond to the public health emergency to the extent the expenses were previously unbudgeted and are otherwise consistent with section 601(d) of the Social Security Act outlined in the Guidance.²

Economic Support (examples below)

- Provision of grants to small businesses to reimburse the costs of business interruption caused by required closures.

- Local government payroll support program.

- Unemployment insurance costs related to the COVID-19 public health emergency if such costs will not be reimbursed by the federal government pursuant to the CARES Act or otherwise.

- Consumer grant program to prevent eviction and assist in preventing homelessness be considered an eligible expense?³

- Employment and training programs for employees that have been furloughed due to the public health emergency, if the government determined that the costs of such employment and training programs would be necessary due to the public health emergency.

- Program to assist individuals with payment of overdue rent or mortgage payments to avoid eviction or foreclosure or unforeseen financial costs for funerals and other emergency individual needs.

- Grants to small businesses to reimburse the costs of business interruption caused by required closures.

- Governments have discretion to determine what payments are necessary. A program that is aimed at assisting small businesses with the costs of business interruption caused by required closures should be tailored to assist those businesses in need of such assistance. The amount of a grant to a small business to reimburse the costs of business interruption caused by required closures would also be an eligible expenditure.

- Any other COVID-19-related expenses reasonably necessary to the function of government that satisfy the Fund’s eligibility criteria.

Where can I find more information?

- More SPARKinfo

- County FAQs from State https://covid.ks.gov/wp-content/uploads/2020/07/County-FAQ_Office-of-Recovery.pdf

- Municipality Toolkit

- [email protected] and 620-238-2304