FAQ's - For Most Current Personal Property Publication Guide PDF (Click Here)

What is personal property?

According to statue, personal property is every tangible thing which is the subject of ownership, not forming part or parcel of real property.

What personal property is taxable?

By law, all property in this state, not expressly exempt therefrom, is subject to taxation (see section V, for exemptions

How is personal property classified and assessed in Kansas?

Kansas personal property is classified by the Kansas Constitution, and interpreted by PVD (Property Valuation Department).

PVD dictates to all counties how Kansas personal property is to be valued for taxation. PVD prescribes specific valuation guides for all Kansas county personal property appraisers to use. In general the guides direct the appraiser toward a market value on the various items (vehicles, watercraft, aircraft, mopeds, ATV’s etc.) and that market value is multiplied by the prescribed percentage (partial assessment by Kansas Statutes) to arrive at an “assessed” taxable amount. This assessed amount is taken and multiplied by the mill levy for your taxing district (city or township) to arrive at your yearly tax bill.

Article, 11, Section 1 of The Kansas Constitution provides that: Tangible personal property shall be classified into six subclasses and assessed uniformly by subclass at the following assessment percentages: See Table Below

Mobile homes used for residential purposes .............................. 11.5% *

Mineral leasehold interests except oil leasehold interests the average daily production from which is five barrels or less, and natural gas leasehold interests the average daily from which is 10 mcf or less, which shall be assessed at .........................................................................................30% **

Public utility tangible personal property including inventories thereof, except railroad personal property, including inventories thereof, which shall be assessed at the average rate all other commercial and industrial property is assesse................................................................................................33% ***

All categories of motor vehicles not defined and specifically valued and taxed pursuant to law enacted prior to 1985............................................ 30% ****

Commercial and industrial machinery and equipment which, if its economic life is seven years or more, shall be valued at its retail cost when new less seven-year straight-line depreciation, or which, if its economic life is less than seven years, shall be valued at its retail cost when new less straight-linedepreciation over its economic life, except that, the value so obtained for such property, notwithstanding its economic life and as long as such property is being used, shall not be less than 20% of the retail cost when new of such property...............................................................................25%

All other tangible personal property not otherwise specifically classified

..................................................................................................................... 30%

*The same as mobile homes considered real property.

**Beyond the scope of this publication. Contact the county appraiser’s office for more information.

***State-assessed and beyond the scope of this publication. Information in this publication does not apply to state-assessed property.

****This classification is only applicable to non-highway titled motor vehicles and motor vehicles operated over 20,000 pounds on public roads. Motor vehicles operated under 20,000 pounds on public roads and "recreational vehicles" are appraised, assessed and taxed pursuant to statue (KSA 79-5l00 series).

Who needs to list personal property for taxation?

Everyone with personal property is to list and report it to the County Appraiser’s office by March 15th of each year. The owner or his relative should sign and affirm that the listing of property is accurate. The signed list is then valued (as prescribed by PVD) and placed on the tax roll for that particular year. A bill will follow in late November for the first half payment due by December 20th of each year.

KSA 79-303 states "Every person, association, company, or corporation who owns or holds, subject to his or her control, any taxable personal property is required by law to list the property for assessment."

The property of: Is listed by:

A Ward His or Her Guardian

A Minor His or Her Father; if not living or unsound, then His or Her Mother; if neither living, by the person In charge of the property.

A Trust for the Benefit of Another The Trustee

An Estate of a Deceased Person The Executor or Administrator

Held in Receivership The Receiver

A Corporation A Designee of the Corporation (see question below)

A Company or Firm An agent or Partner (see question below)

If any person, association, company or corporation has in their possession or custody any taxable personal property belonging to others, it shall be their duty to list the property with the appraiser in the name of the owner of the property.

Who must sign the personal property rendition?

The Rendition list of property should be signed and returned to the County Appraiser’s Office. This list is referred to as an Assessment form, and our office staff is capable of assisting the property owner in filing this Assessment Rendition.

By law, every person, association, company or corporation required to list property must personally sign the rendition. In addition, if a tax rendition form preparer prepared the rendition, then the tax preparer must also sign and certify that the information presented therein is true and correct. (K.S.A. 79-306)

When and where does a taxpayer file a rendition?

What penalties apply to personal property?

The County Appraiser’s office is required to assign a penalty (by State Statutes) for late filings, so we encourage all personal property owners to file by March 15th of each year. Any specific questions can be asked via phone 620-724-6431, or by visiting our office on first floor of the Crawford County Courthouse in Girard, Kansas.

If personal property is not listed or if a rendition is untimely filed, the county appraiser is required by law to apply any applicable penalties. These penalties are set forth in K.S.A. 79-l422 and 79-1427(a) as follows:

Date Rendition Filed:

Penalty:

Filed on March 16 through April 15

5%

Filed on April 16 through May 15

10%

Filed on May 16 through June 15

15%

Filed on June 16 through July 15

20%

Filed on or after July 16 through March 15 the following year

25%

Failure to file full and completed statement within one year

50%

Fail to file, omitted or under-reported for more than one year

50%

The county appraiser has the duty of listing and appraising all tangible personal property in the county that is owned by, held, or in the possession of a business. If a taxpayer fails or refuses to file a rendition or, if the rendition filed does not truly represent all the property, the county appraiser has the duty to investigate, identify, list and value such property in an effort to achieve uniformity and equality. (K.S.A. 79-1411(b) and K.S.A. 79-1461)

Penalty Appeal Rights:

The State Board of Tax Appeals (BOTA) has the authority to abate any penalty imposed under this section and order the refund of the abated penalty. In order to appeal a penalty the taxpayer should obtain the proper form from the county appraiser’s office, complete the form, and submit it to the county. The county would then submit the form to the State Board of Tax Appeals for consideration (BOTA). Either party may request that BOTA rehear or reconsider its decision if such request is made within 15 days from the date of BOTA’s decision.

How are motor vehicles appraised?

One of the more recent, taxpayer friendly changes to personal property states that “Machinery and Equipment” purchased after July 1st 2006 is expressly Exempt from taxation, or personal property assessment. This was done to make Kansas a more friendly work State for business owners.

In addition to the above mentioned change, Kansas watercraft by item (boat, motor or trailer) with a purchase cost of $750.00 or less are also expressly exempt.

This does apply to a couple other areas, so if you have any questions please call the Crawford County Appraiser’s Office (620-724-6431) between 8:30 am – 4:30 pm Monday through Friday and we will be most willing to assist you.

Additional Info:

Motorcycles, automobiles and trucks that are tagged to operate at 20,000 pounds or less on public roads are appraised for tax purposes using a formula set forth in laws. The motor vehicles approximate base wholesale price (dealer cost) when first sold to the public is used to "classify" the vehicle within a price range. The mid-point of this price range is then reduced 15% per calendar year (K.S.A. 79-1500 series). Motor vehicles operating over 20,000 pounds or non-highway motor vehicles, are appraised at market value. The market value is generally obtained using valuation publications prescribed by the state. Automobiles owned and leased for a period of time not exceeding 28 days by a car rental company have an excise rental tax imposed in lieu of a property tax (K.S.A. 79-5117).

Motor vehicles used by for hire motor carriers over the road to transport persons or property are state-assessed. Contact the Motor Carrier Section of the Kansas Division of Property Valuation for more information regarding property taxes on state-assessed motor vehicles (913) 296-2365.

What is commercial and industrial machinery and equipment?

The term commercial and industrial machinery and equipment includes tangible personal property that is used to produce income or is depreciated or expensed for IRS purposes such as office furniture and fixtures.

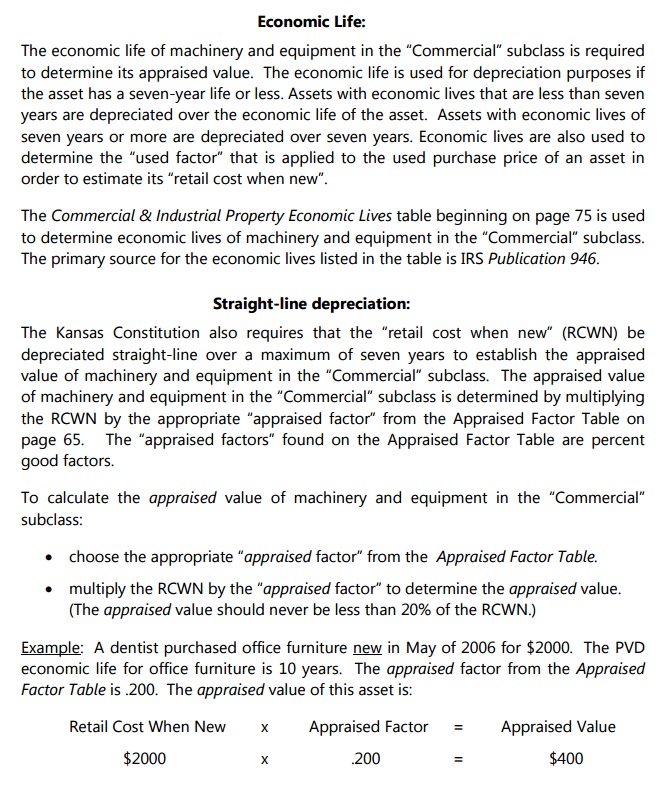

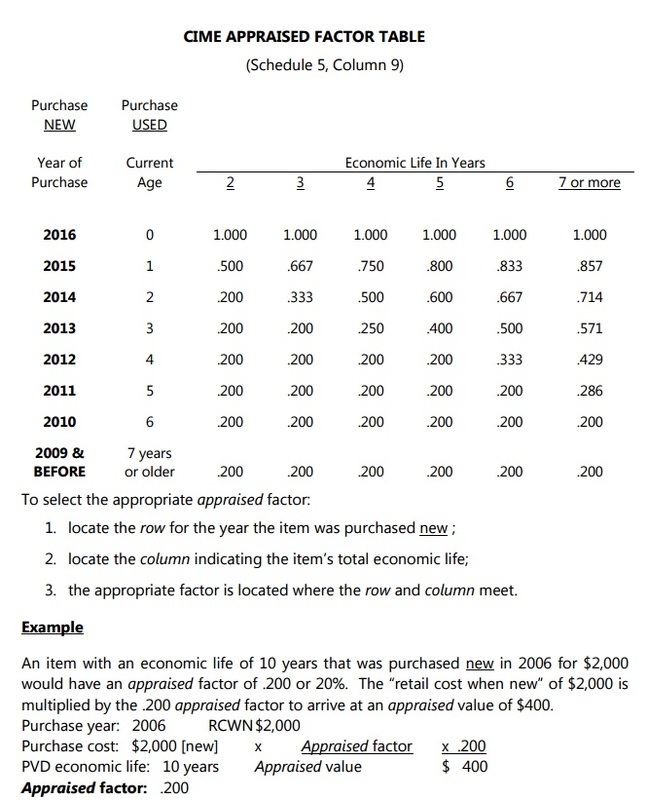

The Kansas Constitution provides that commercial and industrial personal property will be appraised starting at its "retail cost when new" and depreciated straight line over a maximum of seven years. If the economic life of the machinery or equipment is less than seven years, it will be depreciated straight line over the shorter life. However, so long as the property is "being used," the appraised value shall not be less than 20% of the retail cost when new of such property. This classification of property is assessed at 25%.

"Retail cost when new" means the dollar amount an item would cost when new to a purchaser at the retail level of trade. It is not a used sale price, and it is not a wholesale or manufacturer’s cost. It is the total cost a taxpayer incurs to acquire new property and place it in operation in order to use it to produce income over a period of years in a commercial or industrial setting. The term "retail cost when new" does not include sales tax or freight and installation charges that are separate and readily discernible from the set retail price. If a taxpayer cannot determine the retail cost when new of a used item from a reliable source, the county appraiser will estimate the retail cost when new using the used sales price of the item and a formula prescribed by the state. The county appraiser will determine the economic lives of the assets listed on a rendition. Economic lives are based primarily upon IRS publication 946 class lives. Contact the county appraiser’s office for questions regarding economic lives of commercial and industrial machinery and equipment.

Commercial and industrial property should be considered as "being used" until the property’s condition and other objective evidence clearly indicate that it is no longer used and will never again be used and will never again be used in an income producing capacity. For further interpretation of what constitutes being used, contact the county appraiser’s office.

Items used exclusively for business purposes or in certain nonprofit entities are exempt from taxation if the retail cost when new of the item is $250 or less. An "item’ for purposes of the $250 exemption is generally going to be an "item" as it is reported on the rendition. However, if a line item consists of a group of like kind goods that can be used independently, the line item is actually several items. For example, "6 new chairs at $100 each" consists of 6 items qualifying for exemption. On the other hand, an asset that must be used in conjunction with other goods in order to serve its purpose is not an "item". Rather, it is only part of an "item". For example, if a taxpayer lists a "computer keyboard" as a line-item on the rendition, the line-item does not constitute an entire "item". The computer keyboard cannot serve its purpose without the remainder of the computer system; therefore, the keyboard is part of a computer system. The computer system is the item. The keyboard and its other components, even though they may be separately identified and listed, are merely parts of an item for purposes of the $250 exemption.

"Items" of commercial and industrial property with a retail cost when new of $250 or less are not required by law to be reported to the county appraiser. However, if you list all your commercial property without eliminating these exempt items from your list, the county appraiser will exempt them from taxation. In fact, your county appraiser may ask taxpayers to continue to list these exempt items for informational purposes, this does not mean these exempt items will be taxed.

The following is a list of example "items" of machinery and equipment to use as a guideline for the $250 commercial and industrial exemption:

Example "Items" of Machinery and Equipment:

Computer System (including monitor, tape drives, mouse, printer, etc.)

Phone System

Bed (mattress, box springs, frame & headboard)

Alarm System

Shelf (one free-standing shelf unit; as high/wide as used by the entity)

Kitchen pan and lid

Kitchen utensil (example: fork)

Chair

Also refer to instructions on the back of Schedule 5 of the rendition and/or contact the county appraisers office for more information.

What is personal property?

According to statue, personal property is every tangible thing which is the subject of ownership, not forming part or parcel of real property.

What personal property is taxable?

By law, all property in this state, not expressly exempt therefrom, is subject to taxation (see section V, for exemptions

How is personal property classified and assessed in Kansas?

Kansas personal property is classified by the Kansas Constitution, and interpreted by PVD (Property Valuation Department).

PVD dictates to all counties how Kansas personal property is to be valued for taxation. PVD prescribes specific valuation guides for all Kansas county personal property appraisers to use. In general the guides direct the appraiser toward a market value on the various items (vehicles, watercraft, aircraft, mopeds, ATV’s etc.) and that market value is multiplied by the prescribed percentage (partial assessment by Kansas Statutes) to arrive at an “assessed” taxable amount. This assessed amount is taken and multiplied by the mill levy for your taxing district (city or township) to arrive at your yearly tax bill.

Article, 11, Section 1 of The Kansas Constitution provides that: Tangible personal property shall be classified into six subclasses and assessed uniformly by subclass at the following assessment percentages: See Table Below

Mobile homes used for residential purposes .............................. 11.5% *

Mineral leasehold interests except oil leasehold interests the average daily production from which is five barrels or less, and natural gas leasehold interests the average daily from which is 10 mcf or less, which shall be assessed at .........................................................................................30% **

Public utility tangible personal property including inventories thereof, except railroad personal property, including inventories thereof, which shall be assessed at the average rate all other commercial and industrial property is assesse................................................................................................33% ***

All categories of motor vehicles not defined and specifically valued and taxed pursuant to law enacted prior to 1985............................................ 30% ****

Commercial and industrial machinery and equipment which, if its economic life is seven years or more, shall be valued at its retail cost when new less seven-year straight-line depreciation, or which, if its economic life is less than seven years, shall be valued at its retail cost when new less straight-linedepreciation over its economic life, except that, the value so obtained for such property, notwithstanding its economic life and as long as such property is being used, shall not be less than 20% of the retail cost when new of such property...............................................................................25%

All other tangible personal property not otherwise specifically classified

..................................................................................................................... 30%

*The same as mobile homes considered real property.

**Beyond the scope of this publication. Contact the county appraiser’s office for more information.

***State-assessed and beyond the scope of this publication. Information in this publication does not apply to state-assessed property.

****This classification is only applicable to non-highway titled motor vehicles and motor vehicles operated over 20,000 pounds on public roads. Motor vehicles operated under 20,000 pounds on public roads and "recreational vehicles" are appraised, assessed and taxed pursuant to statue (KSA 79-5l00 series).

Who needs to list personal property for taxation?

Everyone with personal property is to list and report it to the County Appraiser’s office by March 15th of each year. The owner or his relative should sign and affirm that the listing of property is accurate. The signed list is then valued (as prescribed by PVD) and placed on the tax roll for that particular year. A bill will follow in late November for the first half payment due by December 20th of each year.

KSA 79-303 states "Every person, association, company, or corporation who owns or holds, subject to his or her control, any taxable personal property is required by law to list the property for assessment."

The property of: Is listed by:

A Ward His or Her Guardian

A Minor His or Her Father; if not living or unsound, then His or Her Mother; if neither living, by the person In charge of the property.

A Trust for the Benefit of Another The Trustee

An Estate of a Deceased Person The Executor or Administrator

Held in Receivership The Receiver

A Corporation A Designee of the Corporation (see question below)

A Company or Firm An agent or Partner (see question below)

If any person, association, company or corporation has in their possession or custody any taxable personal property belonging to others, it shall be their duty to list the property with the appraiser in the name of the owner of the property.

Who must sign the personal property rendition?

The Rendition list of property should be signed and returned to the County Appraiser’s Office. This list is referred to as an Assessment form, and our office staff is capable of assisting the property owner in filing this Assessment Rendition.

By law, every person, association, company or corporation required to list property must personally sign the rendition. In addition, if a tax rendition form preparer prepared the rendition, then the tax preparer must also sign and certify that the information presented therein is true and correct. (K.S.A. 79-306)

When and where does a taxpayer file a rendition?

What penalties apply to personal property?

The County Appraiser’s office is required to assign a penalty (by State Statutes) for late filings, so we encourage all personal property owners to file by March 15th of each year. Any specific questions can be asked via phone 620-724-6431, or by visiting our office on first floor of the Crawford County Courthouse in Girard, Kansas.

If personal property is not listed or if a rendition is untimely filed, the county appraiser is required by law to apply any applicable penalties. These penalties are set forth in K.S.A. 79-l422 and 79-1427(a) as follows:

Date Rendition Filed:

Penalty:

Filed on March 16 through April 15

5%

Filed on April 16 through May 15

10%

Filed on May 16 through June 15

15%

Filed on June 16 through July 15

20%

Filed on or after July 16 through March 15 the following year

25%

Failure to file full and completed statement within one year

50%

Fail to file, omitted or under-reported for more than one year

50%

The county appraiser has the duty of listing and appraising all tangible personal property in the county that is owned by, held, or in the possession of a business. If a taxpayer fails or refuses to file a rendition or, if the rendition filed does not truly represent all the property, the county appraiser has the duty to investigate, identify, list and value such property in an effort to achieve uniformity and equality. (K.S.A. 79-1411(b) and K.S.A. 79-1461)

Penalty Appeal Rights:

The State Board of Tax Appeals (BOTA) has the authority to abate any penalty imposed under this section and order the refund of the abated penalty. In order to appeal a penalty the taxpayer should obtain the proper form from the county appraiser’s office, complete the form, and submit it to the county. The county would then submit the form to the State Board of Tax Appeals for consideration (BOTA). Either party may request that BOTA rehear or reconsider its decision if such request is made within 15 days from the date of BOTA’s decision.

How are motor vehicles appraised?

One of the more recent, taxpayer friendly changes to personal property states that “Machinery and Equipment” purchased after July 1st 2006 is expressly Exempt from taxation, or personal property assessment. This was done to make Kansas a more friendly work State for business owners.

In addition to the above mentioned change, Kansas watercraft by item (boat, motor or trailer) with a purchase cost of $750.00 or less are also expressly exempt.

This does apply to a couple other areas, so if you have any questions please call the Crawford County Appraiser’s Office (620-724-6431) between 8:30 am – 4:30 pm Monday through Friday and we will be most willing to assist you.

Additional Info:

Motorcycles, automobiles and trucks that are tagged to operate at 20,000 pounds or less on public roads are appraised for tax purposes using a formula set forth in laws. The motor vehicles approximate base wholesale price (dealer cost) when first sold to the public is used to "classify" the vehicle within a price range. The mid-point of this price range is then reduced 15% per calendar year (K.S.A. 79-1500 series). Motor vehicles operating over 20,000 pounds or non-highway motor vehicles, are appraised at market value. The market value is generally obtained using valuation publications prescribed by the state. Automobiles owned and leased for a period of time not exceeding 28 days by a car rental company have an excise rental tax imposed in lieu of a property tax (K.S.A. 79-5117).

Motor vehicles used by for hire motor carriers over the road to transport persons or property are state-assessed. Contact the Motor Carrier Section of the Kansas Division of Property Valuation for more information regarding property taxes on state-assessed motor vehicles (913) 296-2365.

What is commercial and industrial machinery and equipment?

The term commercial and industrial machinery and equipment includes tangible personal property that is used to produce income or is depreciated or expensed for IRS purposes such as office furniture and fixtures.

The Kansas Constitution provides that commercial and industrial personal property will be appraised starting at its "retail cost when new" and depreciated straight line over a maximum of seven years. If the economic life of the machinery or equipment is less than seven years, it will be depreciated straight line over the shorter life. However, so long as the property is "being used," the appraised value shall not be less than 20% of the retail cost when new of such property. This classification of property is assessed at 25%.

"Retail cost when new" means the dollar amount an item would cost when new to a purchaser at the retail level of trade. It is not a used sale price, and it is not a wholesale or manufacturer’s cost. It is the total cost a taxpayer incurs to acquire new property and place it in operation in order to use it to produce income over a period of years in a commercial or industrial setting. The term "retail cost when new" does not include sales tax or freight and installation charges that are separate and readily discernible from the set retail price. If a taxpayer cannot determine the retail cost when new of a used item from a reliable source, the county appraiser will estimate the retail cost when new using the used sales price of the item and a formula prescribed by the state. The county appraiser will determine the economic lives of the assets listed on a rendition. Economic lives are based primarily upon IRS publication 946 class lives. Contact the county appraiser’s office for questions regarding economic lives of commercial and industrial machinery and equipment.

Commercial and industrial property should be considered as "being used" until the property’s condition and other objective evidence clearly indicate that it is no longer used and will never again be used and will never again be used in an income producing capacity. For further interpretation of what constitutes being used, contact the county appraiser’s office.

Items used exclusively for business purposes or in certain nonprofit entities are exempt from taxation if the retail cost when new of the item is $250 or less. An "item’ for purposes of the $250 exemption is generally going to be an "item" as it is reported on the rendition. However, if a line item consists of a group of like kind goods that can be used independently, the line item is actually several items. For example, "6 new chairs at $100 each" consists of 6 items qualifying for exemption. On the other hand, an asset that must be used in conjunction with other goods in order to serve its purpose is not an "item". Rather, it is only part of an "item". For example, if a taxpayer lists a "computer keyboard" as a line-item on the rendition, the line-item does not constitute an entire "item". The computer keyboard cannot serve its purpose without the remainder of the computer system; therefore, the keyboard is part of a computer system. The computer system is the item. The keyboard and its other components, even though they may be separately identified and listed, are merely parts of an item for purposes of the $250 exemption.

"Items" of commercial and industrial property with a retail cost when new of $250 or less are not required by law to be reported to the county appraiser. However, if you list all your commercial property without eliminating these exempt items from your list, the county appraiser will exempt them from taxation. In fact, your county appraiser may ask taxpayers to continue to list these exempt items for informational purposes, this does not mean these exempt items will be taxed.

The following is a list of example "items" of machinery and equipment to use as a guideline for the $250 commercial and industrial exemption:

Example "Items" of Machinery and Equipment:

Computer System (including monitor, tape drives, mouse, printer, etc.)

Phone System

Bed (mattress, box springs, frame & headboard)

Alarm System

Shelf (one free-standing shelf unit; as high/wide as used by the entity)

Kitchen pan and lid

Kitchen utensil (example: fork)

Chair

Also refer to instructions on the back of Schedule 5 of the rendition and/or contact the county appraisers office for more information.

For more information refer to the Personal Property Guide

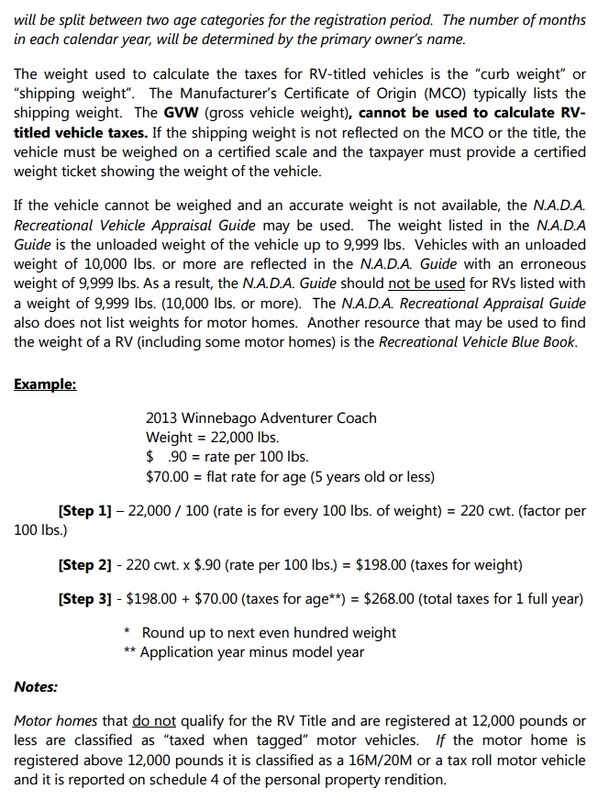

How are recreational vehicles (RV’s) taxed?

To fall under the tax definition of an "RV" the vehicle must be, among other things, for use on a chassis and designed as living quarters for recreational, camping, vacation or travel use; have a body width not exceeding 8 � feet and a body length not exceeding 45 feet; an electrical system which operates above 12 volts and provisions for plumbing and heating. Please contact the county appraisers office for proper classification.

AGE OF "RV"

BASE AMOUNT

$ PER HUNDRED POUNDS OF WEIGHT

0-5 years

$70.00

Plus

$0.90

6-10 years

$50.00

Plus

$0.70

11 yrs. & older to 1982

$30.00

Plus

$0.50

1981 model yr. & older

$30.00 Flat fee

Does not need weight

The weight of the "RV" must be what is generally accepted as its correct shipping weight. If the "RV" is a 1982 model year or newer and the county appraiser or treasurer cannot determine the shipping weight using the information authorized by the state and the law, then the vehicle owner must have the vehicle weighed at a certified scale. The county treasurer has a listing of certified scales in the county.

To fall under the tax definition of an "RV" the vehicle must be, among other things, for use on a chassis and designed as living quarters for recreational, camping, vacation or travel use; have a body width not exceeding 8 � feet and a body length not exceeding 45 feet; an electrical system which operates above 12 volts and provisions for plumbing and heating. Please contact the county appraisers office for proper classification.

AGE OF "RV"

BASE AMOUNT

$ PER HUNDRED POUNDS OF WEIGHT

0-5 years

$70.00

Plus

$0.90

6-10 years

$50.00

Plus

$0.70

11 yrs. & older to 1982

$30.00

Plus

$0.50

1981 model yr. & older

$30.00 Flat fee

Does not need weight

The weight of the "RV" must be what is generally accepted as its correct shipping weight. If the "RV" is a 1982 model year or newer and the county appraiser or treasurer cannot determine the shipping weight using the information authorized by the state and the law, then the vehicle owner must have the vehicle weighed at a certified scale. The county treasurer has a listing of certified scales in the county.